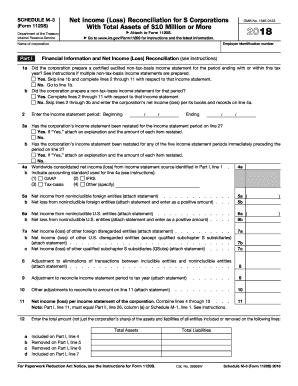

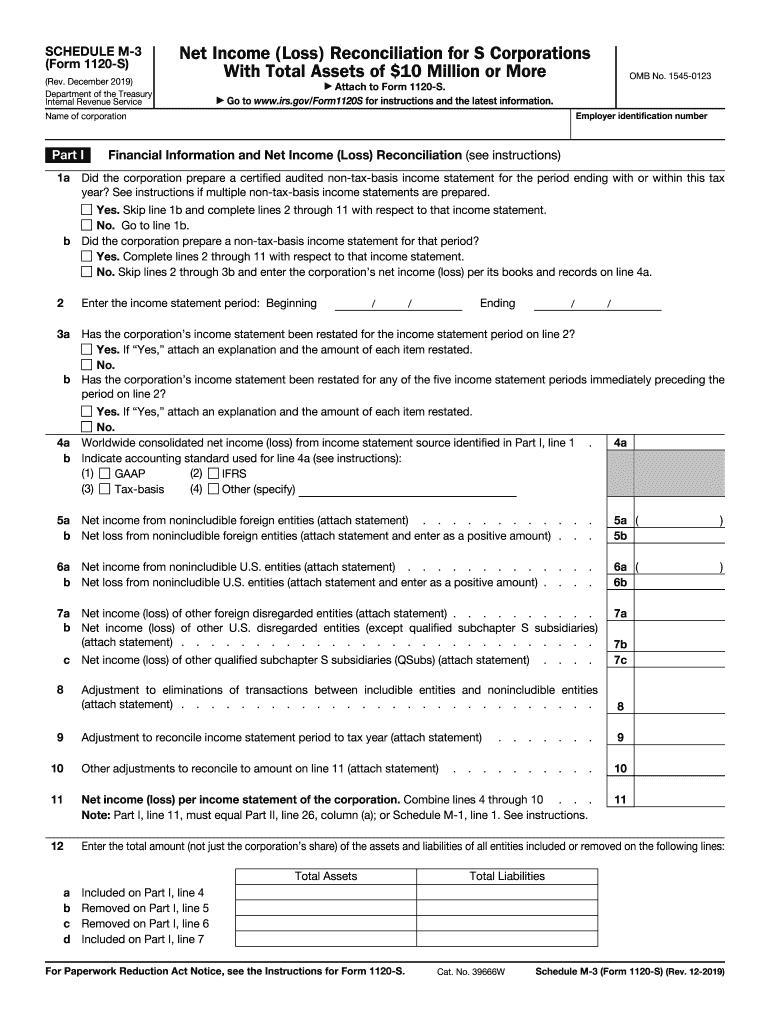

IRS 1120S - Schedule M-3 2019-2026 free printable template

Instructions and Help about IRS 1120S - Schedule M-3

How to edit IRS 1120S - Schedule M-3

How to fill out IRS 1120S - Schedule M-3

Latest updates to IRS 1120S - Schedule M-3

All You Need to Know About IRS 1120S - Schedule M-3

What is IRS 1120S - Schedule M-3?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1120S - Schedule M-3

What should I do if I made a mistake on my IRS 1120S - Schedule M-3?

If you realize there's an error on your IRS 1120S - Schedule M-3 after filing, you can correct it by submitting an amended return using Form 1120S-X. Make sure to provide a detailed explanation of the corrections made, and keep copies of all documentation.

How can I verify the receipt of my IRS 1120S - Schedule M-3?

To verify that your IRS 1120S - Schedule M-3 has been received, you can check the status of your submission through the IRS e-file status tool. You can also call the IRS directly if you prefer talking to a representative about your filing status.

What are common errors to watch out for when filing the IRS 1120S - Schedule M-3?

Common errors include incorrect calculations, missing signatures, and filing with outdated forms or information. It's essential to double-check entries against your financial records and ensure all necessary documentation is included to avoid these pitfalls.

What happens if my e-filing submission of the IRS 1120S - Schedule M-3 is rejected?

If your submission of the IRS 1120S - Schedule M-3 is rejected, you will receive an error code that helps identify the issue. Correct the error based on the code provided, and resubmit your form promptly to avoid potential penalties.

What are the legal implications of using an e-signature for my IRS 1120S - Schedule M-3?

Utilizing an e-signature for your IRS 1120S - Schedule M-3 is acceptable as long as you adhere to IRS guidelines. Ensure your e-signature service supports the necessary security protocols to safeguard your data and maintain compliance with federal regulations.